44+ is second home mortgage interest deductible

Web Here is an overview of which mortgage costs might be tax deductible for you in 2023. Homeowners who are married but filing separately may be allowed to deduct up to the.

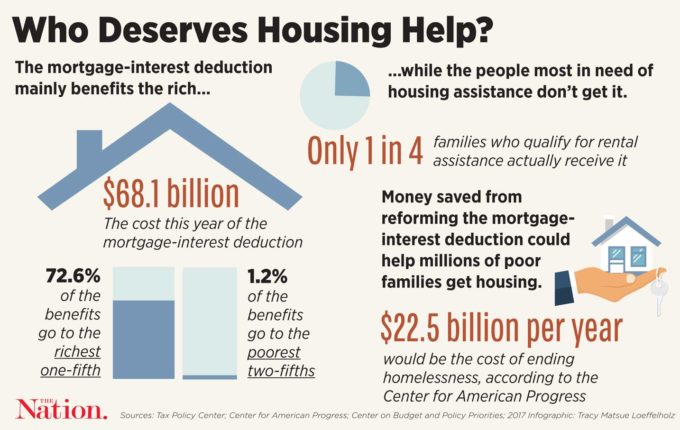

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

State and local real property taxes are generally deductible.

. Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 worth of mortgage debt on their primary or second home. Web If you are married and file jointly you can only deduct interest on 1 million or less worth of home acquisition debt and 100000 or less worth of home equity debt overall.

For debts incurred before December 16 2017 these numbers increase to 1 million and 500000 respectively. Second mortgage tax deductions. Is mortgage interest tax deductible.

Web If youre planning to rent out your second home for part of the year for income however your taxes will be much different with more deductions available and income tax due on any rental income. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large mortgage. Web If that second home is owned by your son daughter or parents and youre paying the mortgage to help out you can only deduct the interest if you co-signed the loan.

Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. Web There are a many types of home loans that qualify for the mortgage interest tax deduction. The limit on deductions is shared between up to two personal residences.

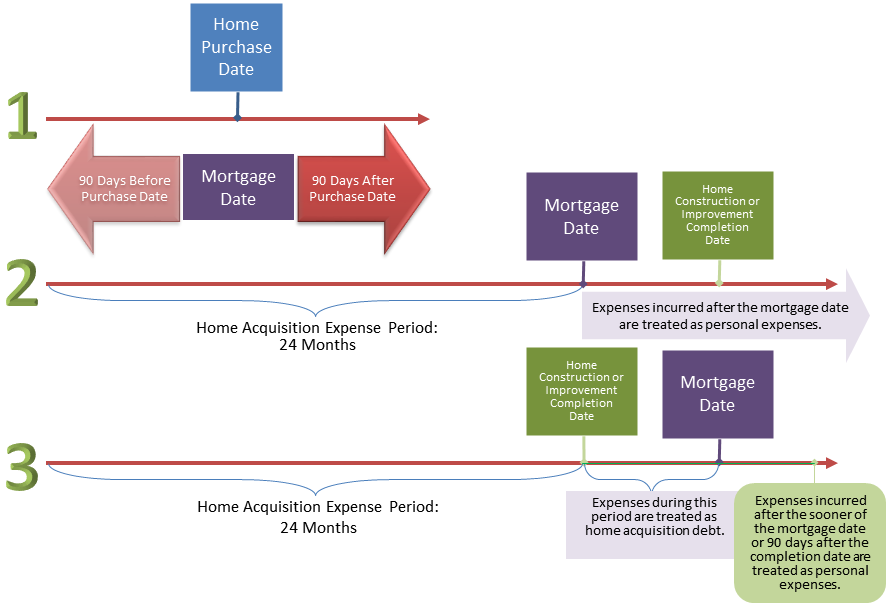

Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage including the amount shown in box 3 of Form 1098-MA Mortgage Assistance Payments but not more than the sum of the amounts shown on Form 1098 Mortgage Interest. Web Homeowners can deduct the interest on a second mortgage associated with home acquisition debt so long as this debt is secured by the second home. Since the limit for a pre 2017 mortgage is 1000000 all 20000 of its interest is deductible.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. These include a home loan to buy build or improve your home. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total taxable income.

Home Equity Home equity mortgage debt is associated with a loan type in which a borrower leverages the equity of their home as a form of collateral. Web If the home was acquired after December 15 2017 the home acquisition debt limit is 750000. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web What is the mortgage interest tax deduction limit for a second home. Homeowners who bought houses before December 16 2017 can deduct. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

You must use it more than 14 days or more than 10 of the total days it is rented out whichever is longer. Home equity loans home equity lines of credit and second mortgage may also qualify. A personal residence is any home you own that is not classified as an investment property.

Now lets add a 2020 mortgage of 2000000 and the same interest of 20000. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. Homeowners can deduct the interest on a.

You can also use the mortgage interest deduction after refinancing your home. If you dont use. Or 375000 if married filing separately.

The home must be a qualified home which the IRS defines in. Web Mortgage Interest DeductionPersonal Residence If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary. Beginning in 2018 this limit is lowered to 750000.

Taxpayers can deduct the interest paid on mortgages secured by their primary residence and a second home if applicable for loans used to buy build or substantially. According to the IRS joint filers have a limit of 750000 and single filers 375000 for personal residences. If you rent out your second home you must also use it as a home during the year.

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Second Mortgage Tax Benefits Complete Guide 2023

3 Things You Need To Know About Second Home Tax Deductions

Top Tax Deductions For Second Home Owners

Mortgage Interest Tax Deduction What You Need To Know

Business Succession Planning And Exit Strategies For The Closely Held

Deduct Mortgage Interest On Second Home

Pdf European Times Public Opinion On Europe Working Hours Compared And Explained Paul Dekker Academia Edu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How A Second Home Affects Taxes Nationwide

Hxk9ohyf5c9lam

The Shame Of The Mortgage Interest Deduction The Atlantic

Loan Vs Mortgage Top 7 Best Differences With Infographics

Mortgage Interest Tax Deduction Smartasset Com

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep